Condo Insurance in and around Saratoga Springs

Condo unitowners of Saratoga Springs, State Farm has you covered.

State Farm can help you with condo insurance

- Saratoga Springs

- Ballston Spa

- Burnt Hills

- Amsterdam

- Mechanicville

- Glenville

- Saratoga

- Gansevoort

- Clifton Park

- Malta

- Greenwich

- Albany

- Schenectady

- Greenfield

- Colonie

- Wilton

- Niskayuna

- Round Lake

- Halfmoon

- Milton

- Rotterdam

- Troy

- lake placid

Home Is Where Your Heart Is

Because your unit is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to smoke or hail. That's why State Farm offers coverage options that may be able to help protect your unit and personal property inside.

Condo unitowners of Saratoga Springs, State Farm has you covered.

State Farm can help you with condo insurance

Put Those Worries To Rest

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Lubica Mills is ready to help you navigate life’s troubles with dependable coverage for all your condo insurance needs. Such considerate service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Lubica Mills can help you submit your claim. Keep your condo sweet condo with State Farm!

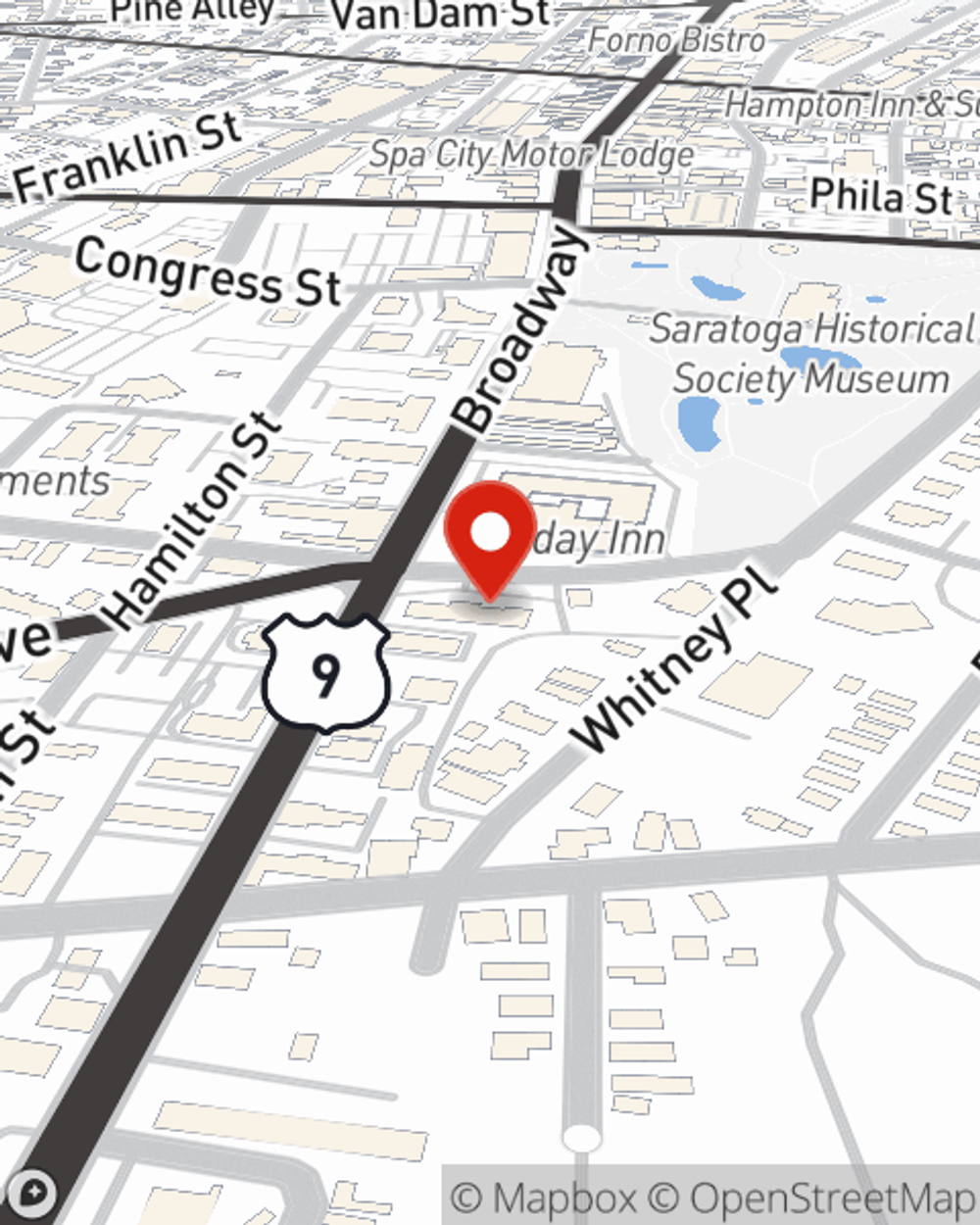

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Visit agent Lubica Mills today to get started.

Have More Questions About Condo Unitowners Insurance?

Call Lubica at (518) 587-6483 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Lubica Mills

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.